Financial experts refer to blue-chip stocks as shares issued by established, financially stable companies. These stocks have steady growth over time, with relatively low price volatility. Blue-chip stocks are usually immense, multinational corporations that are household names and pay dividends regularly. They offer investors a low-risk but slow return on their investments.

Blue-chip stocks often come from the banking, energy, retail, healthcare, and technology industries. These companies typically have long operating histories with strong management teams and solid balance sheets that make them attractive investments for conservative buyers looking for safe but reliable returns on their money. Many blue-chip companies also possess competitive advantages in their respective industries due to brand recognition or economies of scale, allowing them to outperform competitors even when economic conditions aren’t favorable.

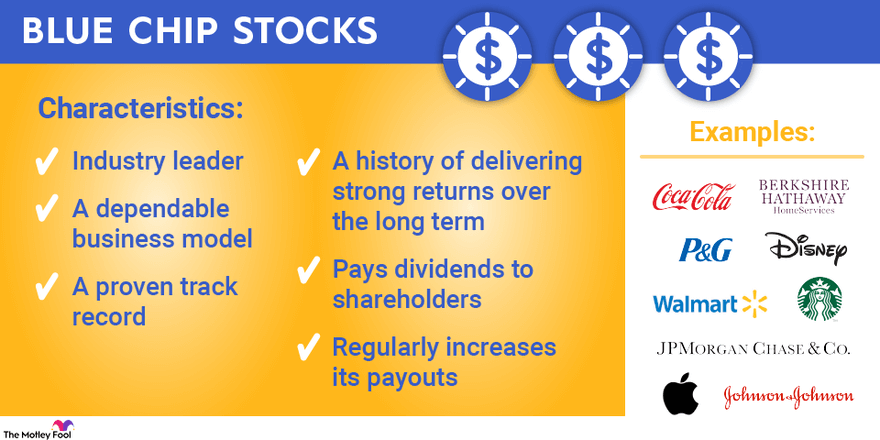

Investments in blue-chip stocks tend to be solid and trustworthy. Typically, these corporations characterize industry leaders who have endured for decades and will continue to do so no matter the market conditions. Companies such as Microsoft, Coca-Cola, Johnson & Johnson, and Procter & Gamble are examples of blue-chip stocks that have been long-term staples. Founded in 1975, Microsoft is one of the world’s leading computer software and operating systems manufacturers. Known for its iconic soft drinks brand, Coca-Cola is one of the world’s largest beverage firms. Johnson & Johnson has been a global healthcare goliath for more than 130 years, and P&G has produced toothpaste and shaving cream for over 180 years.

Why Blue-Chip stocks are considered safe investments

Blue-chip stocks have long been considered to be a safe and reliable form of investing. These stocks are typically characterized by their financial stability, consistent earnings and growth, brand recognition, and high dividend yields. Blue-chip stocks can provide investors with steady returns even when markets become volatile. For these reasons, blue-chip stocks are viewed as low-risk investment opportunities that can help diversify portfolios while delivering more stable returns than speculative investments. Blue-chips have proven resilient in difficult times because they often operate in industries with high entry barriers and many customers. This helps companies maintain consistent revenue streams during market downturns which protect the value of their stock prices over the long term.

Risks of investing in Blue-Chip stocks

The primary risk of investing in blue-chip stocks is that they are affected by economic conditions just like any other stock. If there is an economic downturn or slow growth, the value of these stocks will decrease as well. Additionally, because these companies are already established, their potential for big gains tends to be limited compared to other types of investments. With blue-chip stocks, you may not see as much volatility or rapid growth as you would with more speculative investments, but this also means that you won’t experience such large losses either.

Credit: fool.com

Blue Chip investments: how do you get started?

To invest in these stocks, you must open a brokerage account with an online broker or a full-service brokerage house and deposit funds into your new account. Once your brokerage account is set up, you can research potential investments using available stock analysis tools or seek guidance from a financial advisor if needed. Then you can begin placing orders through your broker, who completes the transactions on your behalf.

What are the benefits of investing in Blue Chips?

Blue-chip stocks are usually the safest investments since they are traditionally the least volatile and carry the lowest risk. Furthermore, these stocks tend to outperform other types of investments during times of economic stress or recession because investors view them as safe havens for their money. There is also less risk involved when investing in blue chips since these larger companies tend to have more resources available to weather any storms coming their way.

Is there an undervalued Blue Chip stock out there?

Blue-chip stocks have a history of solid performance and stability, making them attractive to those looking to get the most out of their investments. But not all blue-chip stocks are created equal, and some may be undervalued compared to others. If wisely picked, these undervalued blue-chip stocks can provide even better returns than traditional high performers in the long run. To find these opportunities, investors should look for companies with good fundamentals but whose price has been temporarily depressed due to external factors such as market sentiment or macroeconomic events outside their control. Companies that successfully manage through these periods can experience outsized returns when they rebound after the storm has passed.

How does a Blue Chip stock add value to your portfolio?

Blue chip stocks are considered to be the backbone of any successful portfolio, offering long-term stability and reliability. Investing in blue chips is beneficial for investors who want to diversify their portfolio while minimizing risk. The term “blue chip” comes from poker, where the most valuable chips are colored blue. Similarly, blue chip stocks represent some of the largest and most reliable companies in the market. These types of stock offer consistent returns over time as they tend to be less volatile than other stocks due to their size and financial strength. They may not always provide high returns but often guarantee steady returns with minimal risk.