Investing in stocks can be a great way to build wealth, but with the many different types of stocks on the market, it can be difficult for beginner investors to understand what makes one stock type different from another. One of the most important distinctions is value and growth stocks. Value stocks appear undervalued compared to similar investments, while growth stocks carry more risk due to their potential for rapid appreciation.

What are Growth Stocks?

Since their earnings growth potential has been higher, investors have become increasingly attracted to growth stocks. These are stocks that companies reinvest the majority of their earnings into rather than paying out dividends to shareholders. In general, growth stocks do not pay dividends or only pay small ones relative to other investments, such as income stocks or bonds. All investments carry associated risks and rewards, and growth stocks are no exception. While there is potential for high returns with these investments, they can also be quite volatile, meaning substantial losses and gains are possible. Investors should research any potential investment thoroughly and understand all risks before investing. Despite the associated risks, growth stocks offer an attractive option for investors looking to achieve potentially high returns over time through reinvested earnings rather than dividends.

Compared to other investment strategies, growth stock investing requires a long-term commitment and strict discipline, as there will be periods of volatility along the way. Growth stock investors should focus on companies with solid fundamentals such as sales, profits, cash flow, and balance sheets. They should look into management teams with impressive track records, competitive advantages, and attractive products or services that can make a difference in the market. In addition, they should research how well these companies are performing relative to their peers regarding valuation metrics, return on equity, and earnings per share growth.

Stocks in these categories are often seen as higher-risk investments but can also provide large rewards. The largest technology companies in the world today, Amazon, Facebook, and Google, are examples of growth stocks.

Credit: anchorcapital.com

What are Value Stocks?

A value stock is a share of a mature company that sells at a lower price than its intrinsic value. These stocks offer high dividend yields and can be an excellent option for investors looking for income and relatively low volatility. The concept of value investing refers to buying stocks with a lower price based on their actual or intrinsic value, as determined through fundamental analysis. Value stocks typically come from companies in established and mature industries that are considered undervalued by the markets. This type of stock offers more potential for downside protection than higher-priced growth stocks due to its low-cost basis. It can provide consistent returns over time, with dividends paid out regularly to shareholders. Value investing requires patience as the underlying businesses may take longer than expected to reach their full potential but can provide significant returns when the market begins pricing them higher relative to their value.

Value stocks have been a popular investment strategy for long-term investors. They focus on undervalued companies, expecting their stock prices to increase over time, thereby creating significant returns. Other investors often overlook value stocks due to their seemingly lackluster performance in the short term, but they can be profitable over the long haul. Investing in value stocks requires patience and understanding of the company’s fundamentals. It is crucial to analyze balance sheets, income statements, and cash flow statements to determine whether a company is actually undervalued. Many savvy investors also look for catalysts, such as management changes or industry trends that could trigger future growth opportunities. Ultimately, investing in value stocks can be a great way to generate consistent returns at minimal risk when done correctly.

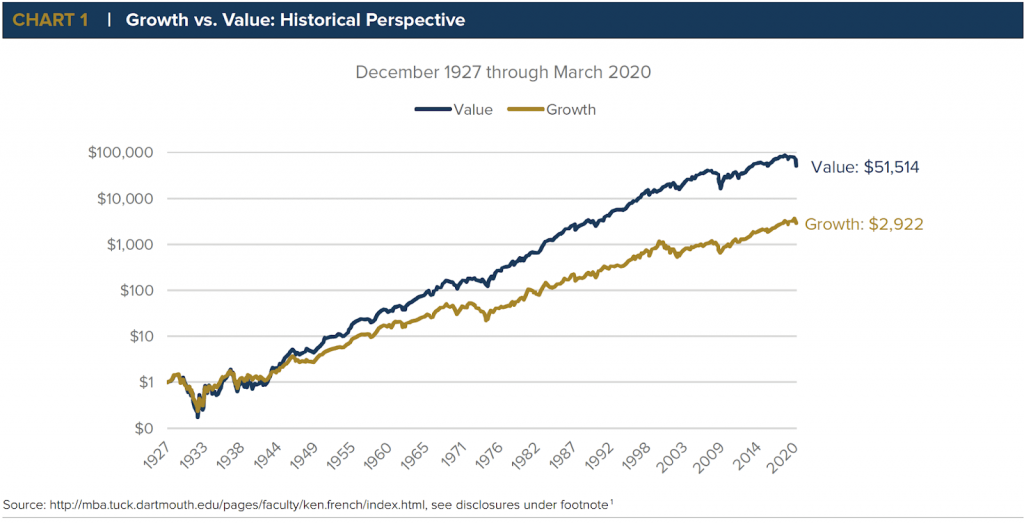

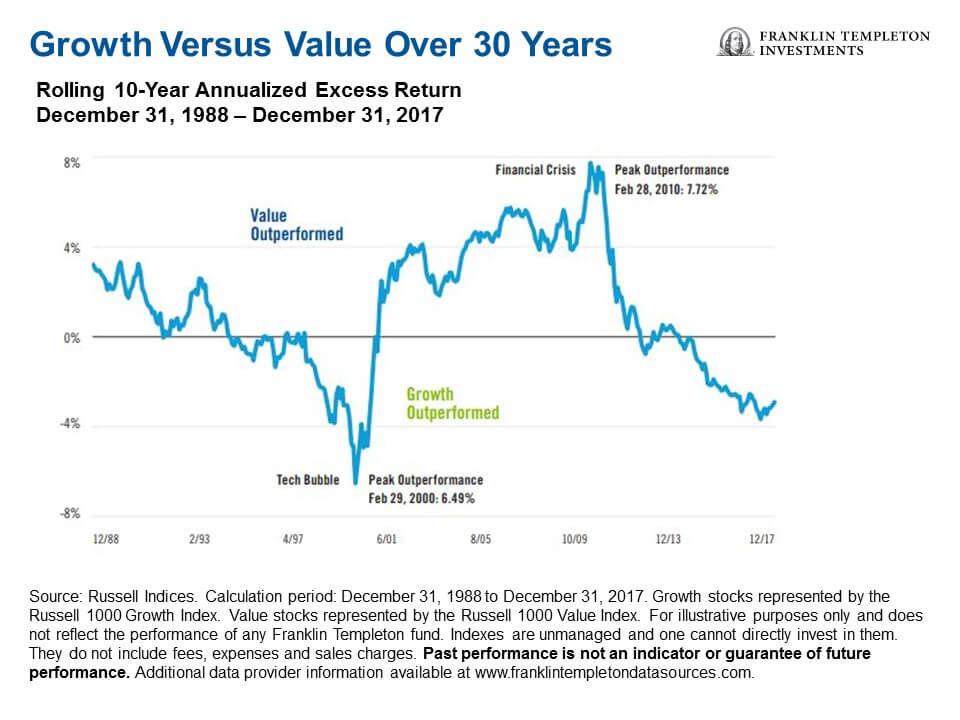

Growth Stocks vs. Value Stocks

- Earnings and Revenues: Growth stocks usually have high earnings growth potential and reinvest most of their earnings into growth, while value stocks have lower earnings growth potential but typically pay dividends.

- Market Capitalization: Growth stocks are usually from companies with high market capitalization, while value stocks are usually from companies with lower market capitalization.

- Dividend Payments: Growth stocks usually pay little or no dividends, while value stocks typically pay dividends.

- Price to Earnings (P/E) Ratio: Growth stocks usually have a high P/E ratio, while value stocks have a lower P/E ratio.

- Investment Objective: Growth investors focus on investing in companies with high growth potential, while value investors focus on investing in undervalued companies.

Credit: us.beyondbullsandbears.com

Growth and Value Stocks: Pros and Cons

- Pros of Growth Stocks: Growth stocks offer investors high earnings growth potential and high returns.

- Cons of Growth Stocks: Growth stocks are risky investments and susceptible to market corrections due to their high P/E ratio.

- Pros of Value Stocks: They offer stability and regular income through dividends, which makes them suitable for risk-averse investors.

- Cons of Value Stocks: Value stocks often provide lower returns than growth stocks and tend to be undervalued.

To sum up

The investment horizon is important when investors decide between growth and value stocks. Both types of stocks can be suitable investments depending on the investor’s goals and risk tolerance, but long-term investors may find that growth stocks better suit their investment needs. Growth stocks are typically higher-risk investments, but they have the potential to produce greater returns over a longer period than value stocks. In contrast, short-term investors often prefer value stocks due to their lower risks and steadier performance over a shorter time. Value stocks also offer dividends, giving investors more immediate investment returns. The tradeoff for these advantages is a lower potential for capital gains compared to growth stock investments in the long run.