Did you know that most people who start stock trading fail? The success rate for people who try to make a living from stock trading is only about 4%. These people know how to minimize risk. For example, they diversify their investments and use stop-loss orders to limit losses. But let’s see some more tips to increase your chances of success in stock trading.

Long-term perspective

When it comes to investing, it is important to take a long-term perspective. Adopting a long-term investment horizon means you are more likely to ride out short-term market fluctuations and avoid making impulsive trades based on emotions or FOMO (fear of missing out). With a long-term approach, investors can make decisions backed by research and analysis over months and years instead of reacting quickly to sudden news or changes in the market. A long-term perspective also allows investors to focus on creating capital growth through compounding returns over time. Compounding returns essentially means reinvesting all profits into investments so that they can accumulate over time and generate even bigger profits. This is an effective way for investors to grow their wealth without putting in the extra effort.

Avoid margin trading

Margin trading can be tempting for investors, as it allows them to buy more stock than they could otherwise afford. But investors should be aware that margin trading also amplifies their potential losses. When engaging in margin trading, an investor borrows money from a broker and uses the borrowed funds to purchase additional stocks. This allows the investor to have more money available but multiplies any losses they incur on those investments. Investors who partake in this high-risk strategy should take extra caution, as they may be unable to cover their debts if the market takes a major downturn and their investments decrease rapidly. For these reasons, many financial advisors suggest avoiding margin trading altogether as an investment strategy – especially for inexperienced investors or those with limited capital.

Keep emotions in check

Fear and greed can be powerful emotions that drive us to make impulsive, poorly-timed trades. For traders in the stock market, this could mean taking too much risk or making ill-advised trades that are not part of their plan. While it is impossible to eliminate fear and greed from trading altogether, it is vital to recognize these feelings and keep them in check so they don’t lead to bad decisions. Staying disciplined and following a well-thought-out trading plan is essential for avoiding emotional trading decisions. By having a clear strategy with defined entry and exit points, traders can limit their exposure to losses by reacting calmly instead of impulsively in the face of fear or greed. The ability to recognize when to take profits or cut losses based on realistic expectations helps traders focus on what makes sense for their investment goals rather than succumbing to irrational impulses driven by emotion.

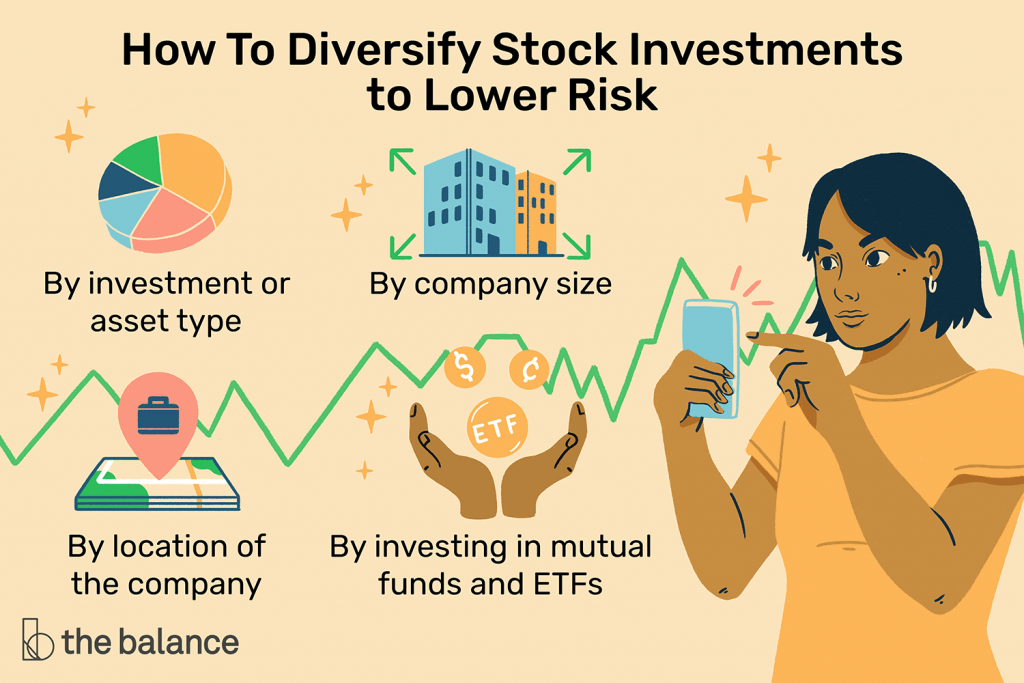

Diversification

A diversified portfolio can minimize the impact of weakening stocks on your holdings. Diversification can minimize your losses if one investment takes a heavy hit, as it distributes losses among other assets. If an investor invests all their money into a single company and the business fails due to unforeseen factors, they may lose everything. Consider, however, the same funds allocated among multiple companies or asset classes. Despite one stock’s failure to perform well, they could still recover some of their investment capital. Each component can manage its respective risks through diversification and proper risk management.

Credit: thebalancemoney.com

Stay informed

Investors need to stay abreast of changes in the market by following relevant news sources and staying informed about company developments. Researching potential investments and financial trends can help traders anticipate significant market shifts, which may lead to lucrative opportunities or costly mistakes. Sticking with reliable resources such as trusted news outlets or analysts can provide helpful insights into understanding how different stocks may move throughout the day or over a longer time.

Set stop-loss orders

Stop-loss orders are easy to set up and can be adjusted anytime. When placing the order, investors will set their desired exit point – the price at which they want their position closed out – and an activation price (also known as the trigger price) that indicates when it should be executed. Once these parameters have been established, the stop-loss order will stay active until it is either triggered or canceled by the investor.

Avoid chasing high-flying stocks

High-flying stocks are typically those that have made a significant move in the stock market over a short period of time. These stocks may go up quickly due to positive news or rumors, but they can also suffer large losses just as fast if those same news stories or rumors turn out to be false. This volatility makes these stocks a risky investment for those who don’t understand the risks involved. Investing in high-flying stocks carries even more risk because these companies often lack fundamentals such as strong earnings.