Stock market scams come in a variety of shapes and sizes, so investors need to recognize the warning signs of fraud. Common types of stock market scams include “pump-and-dump” schemes, boiler room operations, churning stocks, insider trading, and more. These schemes often involve false or misleading information about stocks or investments that are designed to trick investors into buying shares at inflated prices – only for the scammer to cash out when the price drops again. Let’s see how to avoid these common scams.

Research the company

With the stock market reaching record highs, it is more important than ever for investors to avoid stock market scams. Unfortunately, scammers use the market’s bullish sentiment to target unsuspecting individuals looking to make a quick buck. Before investing in any stocks or products related to the stock market, you must research the company and its financials, management, and competitors. Do not rely solely on information from any third-party source, as this information may be biased or incorrect. Instead, read through annual reports and filings with regulatory bodies such as the Securities and Exchange Commission (SEC). This will help you understand how much risk you are taking when investing in any particular asset. Additionally, look into management turnover rates and competitor activity to understand if there are potential issues with a company before investing.

Check for red flags

When it comes to stock market scams, investors should always be on the lookout for red flags. Unsolicited offers that seem too good to be true, promises of high returns with low risk, and pressure to act quickly should all be taken as warning signs that something may not be what it seems. By being aware of these common signs, investors should avoid falling for stock market scams. Take your time researching any offer you receive before making a decision. If an offer seems suspicious, such as excessive guarantees or unrealistic expectations, don’t hesitate to reach out for advice from a trusted financial advisor or the Securities and Exchange Commission (SEC). Additionally, make sure you thoroughly review any contracts involved before signing anything. Doing so could potentially save you from losing money in a fraudulent scheme.

Verify the source

Unfortunately, there are many stock market scams out there that can cost investors thousands of dollars if they’re not careful. In order to avoid falling victim to these scams, verifying the source and checking the credentials of any person or company offering an investment opportunity is essential. It is crucial to research any claims that seem too good to be true and make sure those selling the investment opportunity are registered with the SEC. This ensures that the person or company offering financial advice has been appropriately trained in securities laws. Additionally, research any complaints against them on FINRA’s BrokerCheck website. Knowing who you’re dealing with will go a long way in protecting your investments from fraudulent activities.

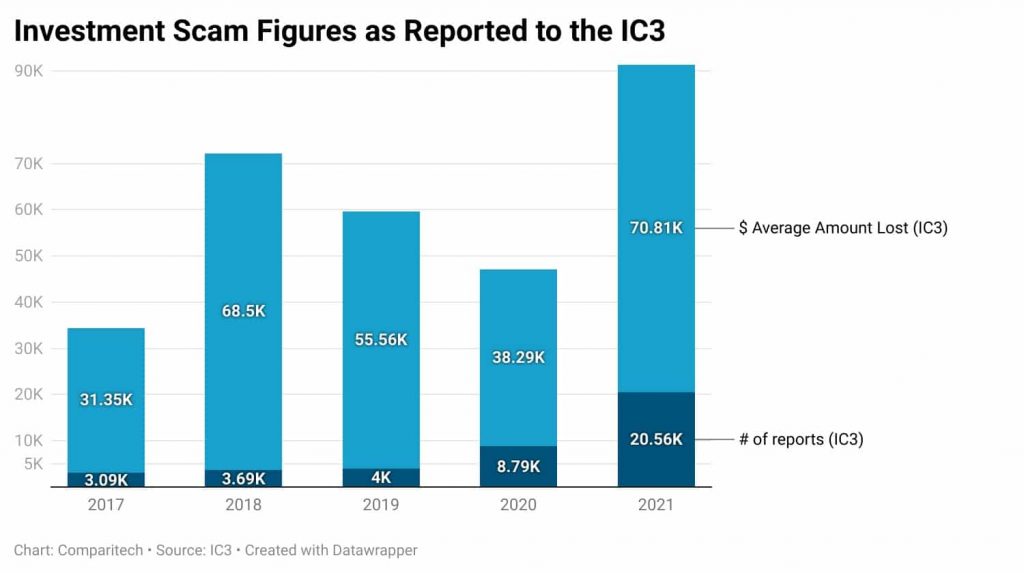

Credit: comparitech.com

Look for a track record

An invaluable step in protecting yourself from hoaxes is to look for a track record when weighing an investment opportunity. A legitimate investment opportunity will have verifiable performance history that can provide investors insight into how successful their buys may be. Investors should steer clear of investing in stocks with little or no history, as these assets come with greater risk and uncertainty about future returns. Besides, take extra caution if someone is trying to sell you on a “once-in-a-lifetime” investment opportunity that promises impressive returns but has no proof of its legitimacy.

Don’t follow the crowd

Do you ever feel like everyone is investing in a particular stock and that you don’t want to miss out? FOMO (fear of missing out) can cloud your judgment regarding the stock market. Don’t let FOMO lead you to make bad decisions. Too often, scammers use hype to drive up demand for the stock – but if you fall for their tricks, you’re putting your hard-earned money at risk. The most important thing to remember when avoiding stock market scams is that information is power. Do your research before buying a stock; read news reports, check the company’s financial statements, or consult with an experienced investor with a good track record of success in the market.

Be wary of unfamiliar investments

Making money through investing can be a wonderful experience, but it comes with its own set of risks. Never invest in something unfamiliar and never invest based solely on an unsolicited tip. Unsolicited advice could come from anyone, including friends, family, or even strangers who may not have your best interests at heart. When considering a new investment opportunity, research and always ask questions. Understand the risks associated with the investment and how much capital you are willing to risk before committing any funds. Review critical documents such as the prospectus or financial statements associated with the investment to ensure you understand what you’re getting into. Additionally, if it sounds too good to be true, it probably is – don’t get caught up in hype or promises of high rates of return without doing your due diligence first.

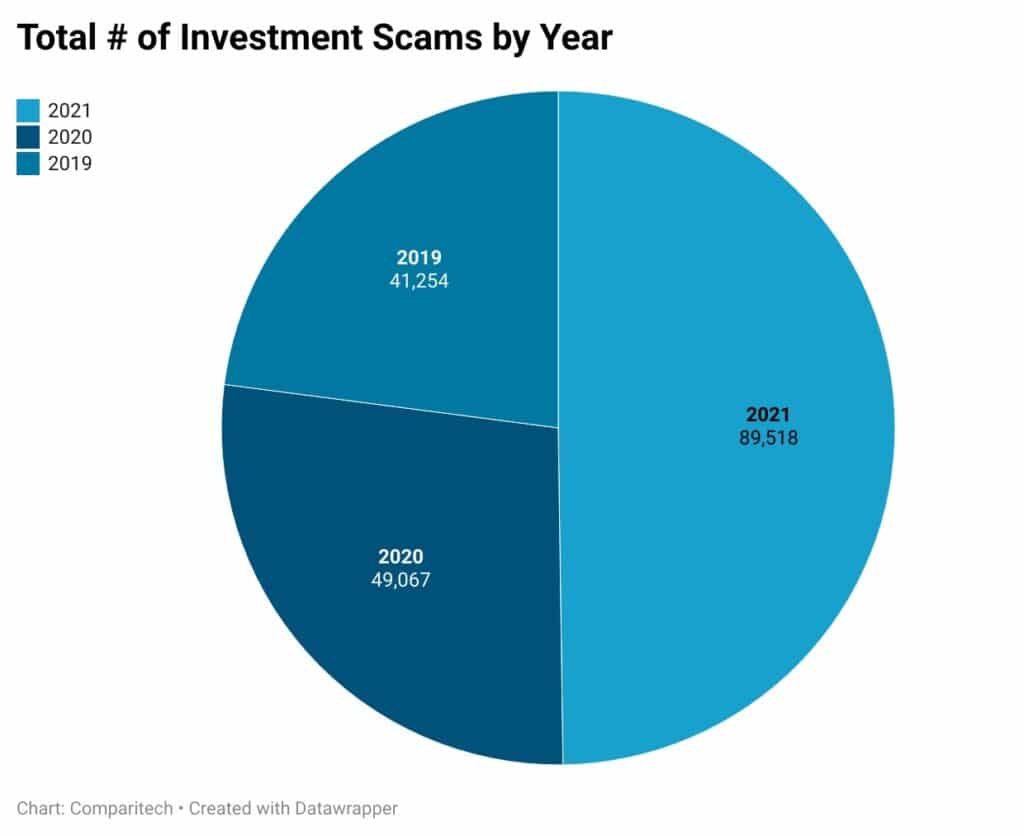

Credit: comparitech.com

Use caution with offshore investments

A growing number of investors are turning to offshore investments in order to increase their returns. Nonetheless, it can be more problematic to regulate and recover from them when things go wrong because they are located outside an investor’s home country. Since this is the case, offshore investors are advised to take precautions when viewing them. It is important that offshore investments are carefully considered so as not to become victims of scams. Investments offered by unregulated offshore firms may be dubious or fraudulent, leaving investors with substantial losses. Furthermore, some countries have less stringent regulations than others, which could make investors even more susceptible to fraud and mismanagement.

To sum up

In the constantly changing and often unpredictable stock market, it is crucial to be aware of potential scams that could cause investors to lose their hard-earned money. By learning to identify and avoid stock market scams, traders can protect themselves from becoming victims of fraud and preserve their capital. Investors should be aware that many scammers will use high-pressure sales tactics to try and entice them into buying in a so-called surefire deal. These deals may sound too good to be true, with promises of significant returns with little or no risk. These offers are generally fraudulent, so investors need to avoid getting caught up in the hype and thoroughly research any potential investments before committing funds.