Having a long-term outlook allows you to take advantage of compounding returns over time, which can help your money grow more quickly. For example, if you take a 10 percent return each year for ten years, you will have doubled your money by the end of that period – meaning that the tenth year earns twice as much as the first year did in percentage return. The benefit here is clear: The longer you invest and the more interest or dividends earned on investments, the more potential for gain.

As part of planning for the future, it’s critical to make sure you have measures in place to protect yourself from risk and significant losses due to life events such as lost employment or economic downturns – both of which can lead to serious problems down the line if they’re not addressed now. Taking appropriate measures should also involve looking at how taxes can affect your overall return on investments so that you’re able to minimize any negative impact these might have on achieving your investment goals.

Finally, it may also be worth reviewing key elements associated with goal setting – including timelines associated with meeting financial objectives that reflect an understanding of projected income and expenses related to family lifestyle needs and desires – as these will also influence how best to maximize returns or limit risk moving forward.

What is a Long-term Investment Strategy?

Investors who pursue long-term investment strategies typically invest over a period of five years or more. It focuses on capital growth and income appreciation rather than short-term profits like shorter-term strategies. The investment timeframe chosen depends on the goals and risk tolerance of the investor. Some people may be comfortable investing in stocks or mutual funds over a few months, while others may wish to invest for several years or even decades. A successful long-term investment strategy takes into account all relevant market conditions, such as current economic, political, and technological trends.

It also utilizes various types of investments—such as stocks, bonds, mutual funds, and real estate—to diversify risk and create stability within the portfolio. Tax considerations are also taken into account when developing a long-term investment strategy in order to minimize taxation liabilities on investments and ensure maximum returns for investors.

Long-term investors observe fundamental analysis—the process of evaluating an asset’s value—to inform their decisions rather than respond to short-term market fluctuations, which are more subject to speculation and personal opinion. This approach allows investors to grow their wealth steadily with less fear of losses due to market volatility over time.

Setting Up a Long-term Investment Plan

A basic, long-term investment plan typically consists of five main components: Risk Tolerance, Time Horizon, Asset Allocation, Investment Selection, and Rebalancing.

- The first step to investing is to identify your risk tolerance. It is important to know how much risk you are comfortable with before making investment choices.

- In simple terms, your time horizon is the length of time you wish to remain invested in the market. Having an appropriate time horizon can help guide decisions about asset allocation.

- Diversification helps reduce risk and provides overall portfolio stability by investing across different asset classes like equities, fixed-income securities, cash equivalents, and alternative investments.

- A successful investment plan involves researching specific investments within each asset class and learning how to analyze and value securities.

- As a final point, investors can take advantage of opportunities in different markets by periodically rebalancing back into target allocations, thereby maintaining desired levels of diversification while reducing the risks associated with large swings between market sectors and styles.

Both investors and advisors need to take careful consideration and diligence in order to develop a successful long-term investment strategy. The plan provides a roadmap for navigating both bullish and bearish markets to achieve optimal returns through favorable market conditions and downturns over extended periods of time.

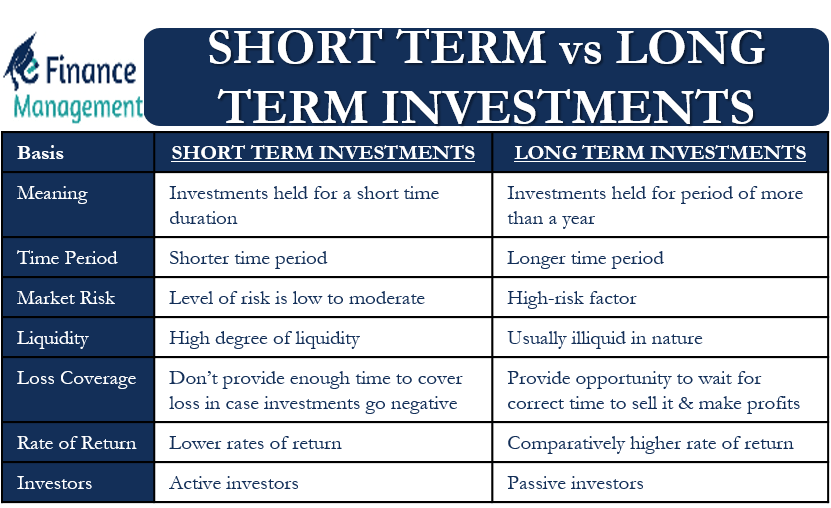

Credit: efinancemanagement.com

Different Types of Long-term Investment

When it comes to investing for the long-term, there is a range of investment strategies and instruments available. To make an informed decision and secure successful returns, it’s important that you understand the difference between these so that you can choose those investments which are more likely to produce the desired results.

- Stocks, or equities, give investors a claim on a company’s earnings and assets, they may provide capital growth over time as well as dividends (payments at fixed intervals).

- Bonds, alternatively known as fixed-income securities, represent loans given by investors to governments or companies; they generally involve periodic payments of interest until maturity, when the principal is repaid.

- Exchange-traded funds (ETFs) and mutual funds provide diversification opportunities for investors who wish to own a variety of investments in one portfolio; unlike stocks or bonds, however, ETFs and mutual funds can carry additional fees, which could affect returns.

- Real estate investments mean purchasing rental properties or REITs (real estate investing trusts).

Seizing on these opportunities will help secure better returns than what could be achieved with simple savings accounts in the long run. An understanding of these different types of investments is crucial for anyone looking to ensure successful long-term investment plans.

To sum up

A long-term investment strategy can help you reach your goals over time and make a positive impact on your financial future. Taking a measured approach, considering all the facts, and asking for guidance from professional advisors can help ensure that you are choosing an approach that works best with your individual circumstances. A clear plan can guide you through any market conditions while protecting against volatile trends – ensuring that you come out ahead on the other side of whatever life throws at you.